Fluctuations in the cryptocurrency market is seen by some people as a sign of instability, therefore they feel that the crypto ecosystem is unpredictable and should be avoided. For most traders and speculators, this is the best mood of the market because huge swings also means increased opportunities to make profit.

A market growing in complexity

Trading cryptocurrencies can be great, but it can also go really fast from an informed investment practice to pure gambling. The huge profit making opportunities that are exposed by the price swings and volatility in the crypto market seems to attract a lot of new entrants, thereby causing a boom in a making that is also growing in complexity.

The growing complex nature of this market has given rise to more in depth measures as traders try to find ways to sustain the consistency of winning trades. Most times, in order to overcome human emotions and cognitive bias, traders have relied on the potentials of machine intelligence.

Trading by automation

Powerful computational technology is systematically replacing the traditional trading methods. These days, machine learning and computer algorithms are used to analysed and sometimes even execute trades. Bots that are developed with plugin capacities are now attached to exchanges and execute trades round the clock based on instructions that are inputted through their settings. These systems tend to function effectively as long as market cycles remain consistent, until certain human factors like the regulation attempts of early 2018 show up. At such points, these algorithms fail.

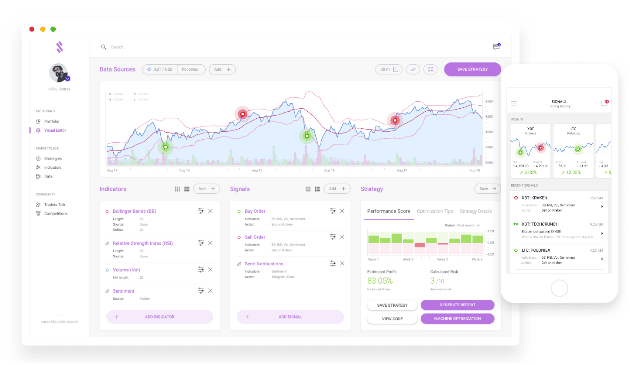

To address the existing loopholes, Signals is building a platform for building, training and monetizing crypto trading strategies with a user-friendly interface, accessible to anyone without any programming skills needed. Signals will connect crypto traders with data science developers.

Combining human and computer techniques

Signals seeks to empower crypto traders with state of the art algorithms from the data science community, which will allow them to optimize their profits. The Signals Platform provides these tools in a user-friendly way. From advanced charting and classic technical indicators to complex statistical models, crowd wisdom based inputs and machine learning algorithms based on media monitoring and sentiment analysis.

This process will connect data science developers with cryptocurrency traders researching and build a new crypto trading platform that would be easy to use for everyone.

By using sophisticated machine learning techniques developed by data science specialists in the Czech Republic and ties to decentralized supercomputers, Signals will offer a simple UI for assembling indicators and creating signals to optimize profit on various cryptocurrency exchanges.

Beyond just trading

The platform provides an environment where anyone can build strategies from specific trading indicators, ranging from technical analysis to crowd wisdom insights, train it on historical data, and monetize such strategies by offering copy trading.

Therefore, summarily the Signals platform will represent a marketplace of data science powered signals for trading cryptocurrencies. Also the platform emphasizes the concept of smart technology, with a strong technological background (AI, algotrading, sentiment analysis, machine learning, potentially powered by a supercomputer).

Other benefits offered by the platform includes the education of traders to get rid of cognitive bias and make smarter decisions while providing an environment to build and optimize smart trading strategies. This gives users an option to monetize their strategies and empower them to make critical, transparent and well influenced investment decisions while reducing the risks and creating tools of tomorrow.

The post Combining Machine Learning and Cognitive Analysis for Profitable Cryptocurrency Trading appeared first on TechWorm.

An analyst with automation techniques can bring change in cryptocurrency mining market. While browsing, I came to know about Volentix which is beyond just trading.

ReplyDelete